MARKET TONE

How quickly things change. At the start of the year, we upgraded our forecasts for the US dollar (USD) in the aftermath of the US presidential election. President Trump’s win and Republican sweep of Congress implied a bullish outlook for the USD to us, given expectations that tax cuts and deregulation would drive US growth and support an extension of “US exceptionalism” that had been the backbone of USD strength and US capital market outperformance in recent years.

Few people learned the lesson of the first Trump term when similar expectations supported a bullish outlook for the USD at the start of the president’s mandate, only for the USD to fall sharply (in 2017). This time, the mistake was to underestimate the president’s desire to reset the global trading system by aggressively raising tariffs on the US’ key trade allies as well as its competitors.

A global trade war is underway. President Trump delayed the full implementation of reciprocal tariffs for three months, but more sectoral tariffs may be implemented shortly. Global trade—which was already slowing—is likely to stall as a result. Household and business confidence have weakened amid the uncertainty, with “DOGE” efforts to reduce US government spending adding to US growth headwinds. Hard data reports have held up relatively well—perhaps reflecting a burst of activity before tariffs really bite—but optimism on the US economic outlook has been replaced with growing recession concerns.

The USD has stumbled badly around the roll out of tariffs. Growth risks have undermined US equity markets while inflation concerns have weighed on US Treasury bonds. The USD, US equities and US government bonds weakened in unison as President Trump increased tariffs on China in dramatic fashion. Additional volatility has emerged recently around intensifying White House pressure on the Fed to cut interest rates and speculation that President Trump may try to replace Fed Chair Powell before his term expires next year, raising concerns about Fed policy independence.

The simultaneous declines in the US currency, stocks and bonds suggest a lack of market confidence in US policymaking (which the ratings agencies may echo) and have eroded market confidence in the “US exceptionalism” narrative. Markets live with uncertainty but usually operate around high levels of conviction. The challenge for investors now is that there are multiple scenarios and projections based on how tariff policy will evolve and everything hinges on decisions made by President Trump. The easiest choice for investors now is to reduce exposure to the USD and US assets generally and reassess when developments allow for a little more certainty around prospects. S&P 500 returns versus the rest of the world so far in April are the worst month in more than 30 years, according to Bloomberg.

We have downgraded our forecasts for the USD significantly for the next 12–18 months but the danger for the USD is that the sell-off seen since January’s high quickens and extends more than we expect at this point. The USD remains—even now—quite strongly valued against its major currency peers. We do not exclude the risk of a further 5–10% fall in the broad value of the USD in the next few quarters.

Longer-term risks for the USD may be a consequence of the US administration’s desire for more balanced US trade. If a significant reduction in the US trade deficit is achieved, a significant reduction in the US capital account surplus will result—effectively meaning reduced demand for the USD and USD-denominated assets among international investors.

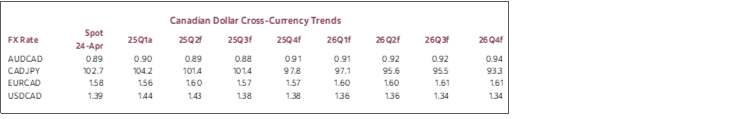

The broad slide in the USD has pulled the Canadian dollar (CAD) back to levels last seen in October. The CAD has strengthened alongside the Mexican peso (MXN) since the USD peaked in January even as both countries grapple with the challenges of the US administration’s fluid tariff policies. For both the CAD and the MXN, much of the tariff “bad news” may be priced in now. Growth momentum in Canada has held up so far this year but may slow somewhat in the coming months. Still, while our forecasts anticipate only modest growth this year and slower growth in 2026, our outlook does anticipate Canada outperforming a US economy that is hamstrung by the impact of tariffs.

That likely means the Bank of Canada (BoC) will maintain the status quo on interest rates this year and only ease again in 2026, when we also expect more cuts from the Federal Reserve (Fed). A wide policy differential between the BoC and the Fed will remain in place this year, in other words, and only narrow slightly in 2026. Weak global trade and slow global growth also suggests that commodity prices will remain subdued. These factors may constrain the CAD’s broader performance somewhat.

Elsewhere among the major currencies, significant fiscal expansion in Germany (and potentially elsewhere across the Eurozone) to bolster defence commitments and build out infrastructure may lift Eurozone growth relative to the US next year. Eurozone equity markets have attracted significant (unhedged) inflows in recent months as investors have retreated from US markets, adding to support for the euro (EUR). In the UK, the Labour government is treading a fine line between forging a closer relationship with the EU while attempting to strike a trade accord with President Trump. We anticipate some gains for the pound (GBP) against a weakening USD but it may struggle to improve materially against the EUR for now.

The Japanese yen (JPY) may be a bellwether for the broader trend in the USD against the major currencies. The Bank of Japan (BoJ) is maintaining a gradual tightening bias, at least for now, in contrast to the easing bias on display in many other jurisdictions. The JPY is one of the most undervalued major currencies against the USD and therefore has perhaps the most ground to make up. The Japanese authorities would perhaps be happy with some (slow) appreciation in the currency, having spent billions of dollars in intervention in recent years trying to stem its losses. A clear push under JPY140 might signal a pickup in momentum in the general USD decline.

Pacific Alliance currencies have experienced mixed fortunes since the USD turned lower at the end of January but the Chilean peso (CLP), the Peruvian sol (PEN) and the Colombian peso (COP) have all weakened since early April when President Trump unveiled, then paused—for most—reciprocal tariffs. Despite the broader slide in the USD, the COP is down 2.5% since April 2nd and ranks as the worst-performing currency in the expanded major currency universe. Lower oil prices are a drag on the COP’s performance. The CLP and PEN are down less than 1%. Volatility in copper, down sharply on the April 2nd tariff news and now still weaker but well off the low, has weighed. Trade tensions, slower global trade and slow growth in China in response to hefty US tariffs are risks for the region.

Shaun Osborne, Canada 416.945.4538

FX FORECASTS

CAD FX FORECASTS

FEDERAL RESERVE AND BANK OF CANADA MONETARY POLICY OUTLOOK

FEDERAL RESERVE ON HOLD WITH THE DUAL MANDATE IN CONFLICT

The Federal Reserve’s key policy rate is forecast to remain on hold at 4.5% throughout the rest of this year before easing by 100bps next year. There is great uncertainty, but we think that a patient FOMC that eventually moves will nevertheless remain in restrictive territory on the policy rate.

One might think that the FOMC should be in a rush to ease given the damage that the Trump administration’s policies could do to growth on a sustained basis going forward. Ultimately that’s going to be the case, which is behind our forecast for easing later on as the US economy opens up disinflationary slack compared to excess demand at present.

The path to the outcome is going to be marked by great uncertainty toward how the Federal Reserve’s dual mandate set by Congress evolves. The FOMC’s duty is to target full employment and price stability. Normally, shocks to the US economy don’t pit those two mandates at odds with one another. These clearly are not normal times. Protectionism marked by a massive surge in US import tariffs (chart 1) will damage US growth and could easily cost millions of American jobs. Protectionism also risks adding to inflationary pressures through a) the immediate effects of import tariffs that pass through to consumers, b) the impact on inflation expectations and behavioural changes, and c) damage to supply chains. Punishingly high tariffs equate to import bans that cause supply chain disruptions including product shortages once more.

It will take time for the FOMC to sort through the data and tea leaves. As Chair Powell has explained, what will guide the Committee is their commitment to evaluate which of their goals strays furthest away from the mandate before deciding upon the appropriate policy response. If the bigger hit is to unemployment than inflation, they’ll ease. If it’s the opposite, they won’t. It will take time, a lot of data, and plenty of further volatile developments until they collectively have the answer as opposed to gambling on what might tip the balance and thereby risking a repeat of their policy failures when inflation was allowed to get out of control.

BANK OF CANADA—NEUTRAL RATE, HARDLY NEUTRAL FISCAL POLICY

Scotiabank Economics forecasts the Bank of Canada to remain on hold throughout the rest of this year before considering possible easing next year. By contrast to the Federal Reserve, the BoC’s policy rate of 2.75% already rests within the estimated neutral rate range of 2.25%–3.25%. That is one reason why the BoC can afford to be patient notwithstanding the importance of trade to the Canadian economy. Being at neutral implies more policy optionality.

A second reason is uncertainty toward how inflation evolves from here. As the BoC put it, key is to monitor “the extent to which higher tariffs reduce demand for Canadian exports….how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.”

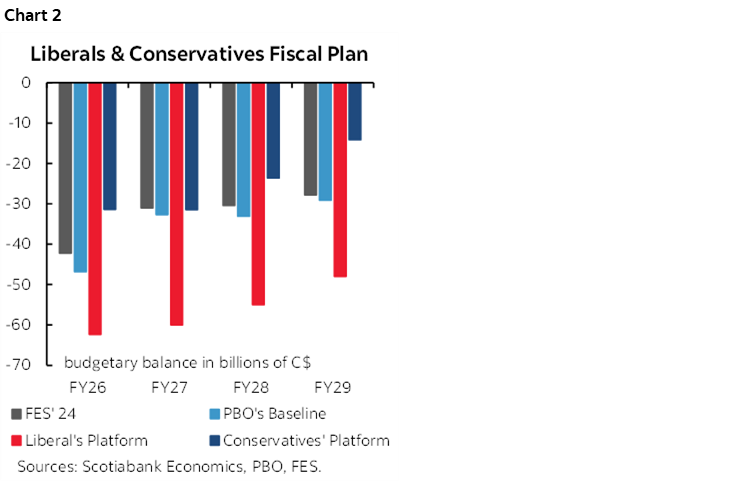

A third reason lies in how fiscal policy evolves. The BoC and private forecasters are watching this with keen interest. The pending election, establishment of a new cabinet, and Parliament’s recall are expected to culminate in an expansionary federal budget perhaps around a June timeline. The magnitude of the potential fiscal response and the direct effects of a weaker economy on finances drive a wide range of possible outcomes for deficits that are rapidly exploding (chart 2). As trade tensions hit supply and demand in the context of a neutral rate stance, the BoC is likely concerned about potentially overdoing combined monetary and fiscal stimulus only to see trade tensions ultimately dissipate in a variation of overdoing it for too long after the pandemic hit.

Derek Holt, Canada 416.863.7707

NORTH AMERICA

MAJOR CURRENCIES

MAJOR CURRENCIES (continued...)

LATIN AMERICA

DISCLAIMERS

FOREIGN EXCHANGE STRATEGY

This publication has been prepared by The Bank of Nova Scotia (Scotiabank) for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Scotiabank, its affiliates or any of their employees incur any responsibility. Neither Scotiabank nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. Scotiabank, its affiliates and/or their respective officers, directors or employees may from time to time take positions in the currencies mentioned herein as principal or agent, and may have received remuneration as financial advisor and/or underwriter for certain of the corporations mentioned herein. Directors, officers or employees of Scotiabank and its affiliates may serve as directors of corporations referred to herein. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable. Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, all members of the Scotiabank group and authorized users of the mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia and Scotiabank Europe plc are authorised by the UK Prudential Regulation Authority. The Bank of Nova Scotia is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available on request. Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities. Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.

SCOTIABANK ECONOMICS

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.