Next Week's Risk Dashboard

- G7+ Summit: Measuring Disunity

- The bogus US victim thesis

- Israel-Iran conflict a key risk

- FOMC: More of the same?

- BoJ: JGB purchase review to dominate

- BoE: Still gradual and careful?

- SNB—Negative rates again?

- BCCh: Hold with cut risk

- BCB: No more handholding

- Riksbank—Worth breaking guidance?

- Norges Bank—Revisiting a conditional hold

- The Aussie Jobs Machine

- UK CPI Coming Off a Peak?

- US, Canadian retail sales to inform consumer momentum

- Bank Indonesia—A case for a cut

- Turkey’s Central Bank—Fool Me Once…

- CBCT—Extending a long hold

- BSP—The balance has tilted

- US markets shut for Juneteenth

Chart of the Week

It’s monepalooza week, with about a dozen global central banks weighing in with their latest policy decisions and guidance. The list includes a combination of majors (Fed, BoJ, BoE) and multiple regional central banks. The degree to which Chair Powell’s patience is being tested and the FOMC’s dot plot will combine with the Bank of Japan’s review of its JGB purchase program to dominate the central bank space.

As the central bankers ponder next moves, the politicians descend upon Alberta, Canada from Sunday through Tuesday for the G7+ meeting. Except it’s not the G7 with some controversial leaders from outside of the G7 invited along. Only Saudi Arabia’s MBS has declined.

US markets will be shut on Thursday for ‘Juneteenth.’ Global macro data risk will mostly focus on a sprinkling of reports such as US and Canadian retail sales, UK CPI, and Aussie jobs.

THE G7+ MEETING—MEASURING DISUNITY

It’s unclear what to expect from the G7+ other than that there will be no summary communique at the end of it all. Good. They’re not very useful anyway. It’s possible that will we see greater traction toward trade agreements amid the exchange of proposals between Canada and the US as one example. It’s also possible that Trump’s presence has the opposite effect. Side meetings and press conferences could dominate. Developing conflict between Israel and Iran is likely to continue for days and could unexpectedly figure prominently.

Of course, the best outcome would be de-escalation of US-driven tensions with other members. Maybe a semi-palatable middle ground consensus may begin to emerge. Failing that, I hope the rest of the world stands its ground against the US administration’s victim narrative.

The Trump administration’s core thesis is that the rest of the world has been taking advantage of the openness of the US current and capital accounts through uncompetitive practices that have prevented market mechanisms from adjusting to achieve renewed balance in the twin current account and fiscal deficits of the US economy. An extension of this thesis is that the US has provided a defence umbrella to the rest of the world that has shirked on such obligations. In order to address such imbalances, the US is out to impose tariffs on other countries, demand trade liberalization, demand higher defence spending by others, and dictate domestic policies such as the elimination of VAT and digital taxes. Some of this could be constructive if it worked, like trade liberalization by all.

But I’ve always argued that this thesis is largely rubbish. For one, a reason why market mechanisms don’t close the current account and fiscal deficits is because US domestic policy keeps feeding them. The US administration keeps giving away tax dollars that it cannot afford to give away without inflaming the deficit and priming the pump in serial fashion and keeps spending too much, while crafting policies that discourage saving behaviour and encourage high spending by consumers. The choices made by the US on education, health, public safety and distributional matters over time have left it in poor standing on such metrics compared to many other countries notwithstanding a high average standard of living.

The US has the tools to remedy this. Because it doesn’t wish to raise taxes, wisely implement its own VAT tax, and address high entitlement spending is no one else’s fault. Therefore, no other country should accept having the solution foisted upon them through punitive measures. Most other countries would also wish they had US-style economic growth despite the victim narrative.

Canada did it. The US can as well. Canada in the early and mid-1990s faced severe imbalances that were driving a very weak economy, high inflation, political discord, high unemployment, large fiscal deficits and unfunded social security obligations. The solutions were politically unpalatable but pursued nonetheless with the added motivation of ratings downgrades and insults from foreign newspapers like the WSJ’s ‘banana republic’ jab. The country got down to work, repaired its fiscal mess that unleashed years of fiscal dividends for a time, and reformed the Canada Pension Plan. It was painful. It required difficult choices. But kudos to the leaders—and the various forces applied upon them—for fixing things.

The world’s answer to the problems in the US should be to fix your own house. I think that’s what the rest of the world is doing as China resists US measures, and ditto for Europe. We’ll see about Canada. If the rest of the world digs in, then it may ultimately force the US to make necessary but difficult choices in the long run.

An added influence upon this posturing by the rest of the world is recognition that the US does not play fair. Or at least not as fair as it thinks. The US has many trade distortions of its own. There is little to no difference on tariffs between the US and Canada, Japan, etc. The US makes heavy use of subsidies (Farm Bill, autos, defence, chips, air, etc etc) and along with China dominates global subsidy programs. EM uses tariffs and non-tariff barriers because they can't keep up with—for example—US and European ag subsidies etc.

And on defence shirking, that’s a partial truth. Yes, countries should live up to their commitments. But five-sixths of US government spending is not on defence which is not the primary driver of its fiscal mess by any stretch. Further, the motives and needs for past defence spending surges by the US have at times been contested by allies. The US has provided a defence umbrella, other countries have shirked, but the imbalance is not as severe or pure as the US administration’s demands would suggest.

FEDERAL RESERVE—MORE OF THE SAME?

The FOMC meets on Tuesday and Wednesday and the meeting will culminate in a full set of communications. A statement (2pmET) will be accompanied by a fresh Summary of Economic Projections including the so-called ‘dot-plot.’ Chair Powell’s press conference follows thirty minutes later.

No one expects the policy rate to be adjusted. It’s unlikely that there will be material changes to the quantitative tightening parameters or market supports. Recall that the pace of Treasury run-off was reduced from US$25B/month to $5B/mth in the March FOMC statement and likely remains on auto pilot. Powell may be asked to opine on the view of some Senators that the Fed should stop paying interest on reserves and I would expect him to shoot that down rather firmly by displaying a greater awareness of the broad consequences than the Senators are able to grasp.

The focus therefore turns to the projections including the Committee’s views on potential policy rate adjustments in future, and Chair Powell’s press conference.

On the dot plot, the Committee’s median projection for rate cuts may be trimmed. Their 50bps of cuts in 2025 in the March plot has five remaining meetings in which to deliver them. June and probably July seem out. Powell is unlikely to say anything that would tee up a cut on July 29th and may indicate that’s unlikely. It’s unclear that the Committee will have the confidence to cut twice in the remaining three meetings after July. My hunch is they could trim that down to one which would be consistent with the views expressed by some members, while others have indicated they are still fine with the March projection.

Why trim? The job market remains resilient, for one. The 139k official gain in nonfarm payrolls and the 220k rise in the San Francisco Fed’s weather-adjusted gain in nonfarm payrolls continued to avoid the fear factor of an immediate weakening of payrolls. Core inflation has been softening on a trend basis, but I would hope that the Committee members would be nervous toward data quality given the role of tamped down SA factors with a strong recency bias that may not be suitable (chart 1) and given that BLS budget cuts have driven the share of the basket subject to guesswork to sky high proportions (chart 2).

The macro forecasts may do more of the talking. Watch how the forecasts for inflation relative to the unemployment rate change and which one deteriorates more. That may provide a hint at policy directions. Charts 3–5 show our forecasts compared to the FOMC’s March median projections for growth, unemployment and inflation.

Chair Powell has been very clear that the Committee will be patient as it evaluates which part of its dual mandate may suffer more as the nature of the trade shocks likely raises unemployment and inflation going forward. Until they have confidence on which one dominates, they won’t have confidence on the appropriate course of action and that empirical question requires a lot of data.

What might instead rule the day is ongoing policy volatility within the Trump administration. Instability in the broader policy framework increases monetary policy uncertainty.

Also watch the 2026 dots. Previously, they showed a further 50bps of cuts for 100bps in total over 2025–26. Markets are leaning toward 125bps in total over both years.

Finally, will any participants change neutral rate views? Chart 6 shows how a model used by Fed economists including the late Thomas Laubach has evolved over time. It estimates a real neutral policy rate of about 75bps. NY Fed President Williams has indicated he sees no reason to materially change estimates. He may be one of the lower dots shown on the same chart, but his other colleagues generally appear to be biased higher.

BANK OF JAPAN—JGB PURCHASE REVIEW TO DOMINATE

The Bank of Japan might be more interesting and impactful to domestic and global markets than the FOMC and just ahead of it this time.

The excitement won’t come in any forecast revisions, however, since the last one for the April round (here) won’t be updated again until the late July meeting.

Nor will the excitement come in the form of policy rate changes. Markets are priced for no change to the 0.5% target rate. Consensus is unanimously aligned with markets.

The excitement may come in two forms. Will Governor Ueda’s press conference offer refreshed guidance on the future potential path for policy rate adjustments? A case for teeing up a hike as soon as the July meeting could be based upon the fact that Tokyo core CPI inflation has been on a tear for several months now (chart 7). At issue, however, is whether Ueda sticks to prior guidance that he wants to evaluate further developments in the US and knock-on effects on world markets and economies before deciding on a near-term course of action. At present, markets are priced for no action at the July meeting with minimal pricing for a rate hike through the end of the year.

Will the BoJ alter its purchase pace of Japanese government bonds (JGBs)? This may be the most impactful part of the outcome. Ever since abandoning the ‘around 0%’ target for the 10-year JGB yield, the BoJ has been reducing the pace of monthly purchases of JGBs on a quarterly profile (chart 8) and particularly in the high frequency purchases in the ten-year bucket (chart 9). The aim here has been primarily driven by a desire to reduce market dysfunction that was previously arising and partly driven by the fact that the BoJ owns just under half of the Japanese government bond market (chart 10).

When the BoJ last laid out its plan for monthly JGB purchases in July of last year (here) it committed to reducing purchases in a predictable manner with an explicit path laid out until March 2026 as per the aforementioned chart. It said at the time that it would conduct an interim assessment of the plan at the June 2025 meeting—this one—and at the same time possibly review plans after March 2026. Even last July the BoJ said “in the case of a rapid rise in long-term interest rates, the Bank will make nimble responses by, for example, increasing the amount of JGB purchases.

Fast forward to now. The 10-year JGB yield has recently risen by about 35bps since last July, most of which occurring this year. The 30-year long bond has risen by about 70bps over this period and also mostly this year.

Weaker recent JGB auctions have contributed to the volatility in long-term yields across other countries through the arbitrage and carry effects out of Japan. This has fed speculation that the BoJ may back off somewhat on planned reductions to the pace of JGB purchases. Bloomberg survey respondents indicate expectations for this pace to be reduced in half (ie: relatively more JGB buying than the previous schedule). They may be simply going with the opinions of a former BoJ official. It’s uncertain whether a) there will be a fresh and reduced purchase plan laid out at this meeting, and b) by what amounts if so.

BANK OF ENGLAND—KEEPING IT TOGETHER

The Bank of England issues a fresh policy statement on Thursday. There will be no forecast update until the August 7th decision with the last forecast having been delivered in May (here).

No Bank Rate change is expected at this one. The BoE’s “gradual and careful” easing mantra has been expressed in the form of an alternating pattern of cuts and holds. After four 25bps cuts starting last July and including a cut in May that have collectively taken the rate down by 100bps, this meeting is expected to whiff. Markets are mostly priced for the next cut to occur in August.

At a policy rate of 4.25%, policy is still meaningfully restrictive relative to neutral rate estimates that could be at or slightly above 3%. The BoE’s Catherine Mann produced this useful deck on the topic last month for anyone who wishes to delve further into the matter.

Recent core inflation has been a touch warmer. Chart 11 shows the m/m % change across like months of April and how the latest month was relatively warm. May’s CPI figures on Wednesday—just before the BoE the next day—may further inform the recent trend.

Nevertheless, the economy has been sharply weakening which raises disinflationary pressures. GDP fell by -0.3% m/m in April but grew by 0.7% q/q SA nonannualized in Q1. Most other readings for April—when US-driven tariff wars dramatically escalated and after rising evidence of the consequences of non-dom UK tax policies—also deteriorated. Payroll employment has fallen every month this year.

Thus, we’re likely to hear Governor Bailey reiterate that a gradual pace of easing remains appropriate. Key may be the degree to which the rest of the Monetary Policy Committee agrees with him. Bailey’s crew was divided around the cut in May by a 5–4 vote outcome with two of them supporting -50bps but two others advocating in favour of a hold.

BCCH—STILL ON HOLD?

Banco Central de Chile is expected to hold its overnight rate target at 5% with risk of a cut on Tuesday. Our Chilean economist Aníbal Alarcón expects a 25bps cut. Minutes to the prior meeting left open the option to cut at this meeting based on developments such as softening inflation with headline falling to 4.4% y/y in May. Whether that’s enough to motivate a central bank to come off the sidelines where it has stood since the start of this year isn’t clear.

BCB—NO HAND HOLDING THIS TIME!

This could be the trickiest call over the hike cycle to date. Consensus leans toward holding the Selic rate at 14.75% but a notable minority thinks there could be another 25bps hike on Wednesday.

A cumulative 425bps of hikes have been delivered since they began in September 2024. They started at a 25bps clip, and then three straight 50bps hikes were delivered before shifting down to a 25bps increase in early May. Now the uncertainty stems from the lack of clear forward guidance in the May statement that stood in contrast to the explicit guidance that was being providing over prior statements. This one said:

“For the next meeting, the scenario of heightened uncertainty, combined with the advanced stage of the current monetary policy cycle and its cumulative impacts yet to be observed, requires additional caution in the monetary policy action and flexibility to incorporate data that impact the inflation outlook.”

RIKSBANK—WORTH BREAKING GUIDANCE?

Sweden’s Riksbank delivers its latest policy decision on Wednesday. Most expect a 25bps cut but a minority think it might hold again in a continuation of the pattern in place since the last reduction in January. Markets are mostly priced for a cut plus half of another through to year-end.

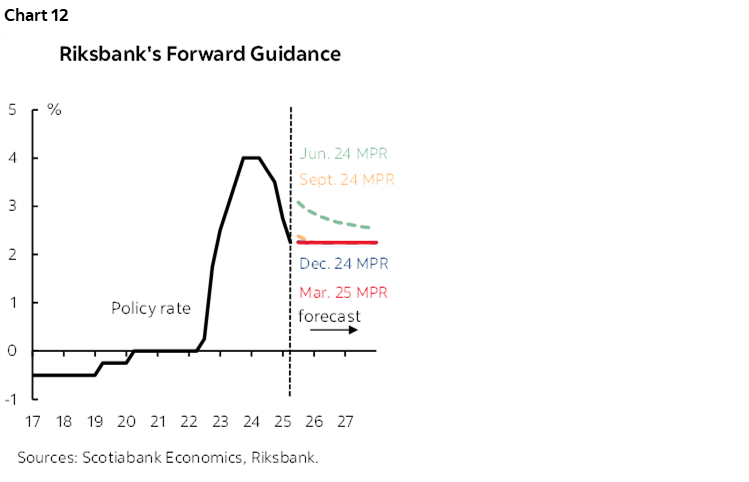

A fresh Monetary Policy Report with new forecasts is due with this decision (see prior edition here). The last formal rate guidance pointed toward no further rate adjustments over the forecast horizon (chart 12). That, however, came with an asterisk.

The May 8th Monetary Policy Update said this: “The Executive Board assess that monetary policy is currently well-balanced and that it is therefore wise to now await further information to obtain a clearer picture of the outlook for economic activity and inflation. At the same time, even though uncertainty is significant, the Executive Board assesses that it is somewhat more probable that inflation will be lower than that it will be higher than in the March forecast. This could suggest a slight easing of monetary policy going forward.”

Since then, underlying inflation has been stable at 2.3% y/y but it was weaker in month-over-month terms than like months of May in history. Further, total CPI inflation is non-existent at 0.2% y/y.

Key will be refreshed explicit forward guidance in terms of whether a possible cut is just a tweak, or thought to require follow up. Most forecasters are divided between ending 2026 at 2% or 1.75%.

NORGES BANK—REVISITING A CONDITIONAL HOLD

Norway’s central bank is widely expected to remain on hold at a deposit rate of 4.5% on Thursday. Consensus is aligned and markets have nothing priced.

Key will be forward guidance. There will be a fresh MPR with new forecasts this time and the last one from March is available here.

More recently, the last decision on May 8th said this: “The uncertainty surrounding the outlook is greater than normal, and the future path of the policy rate will depend on economic developments. The Committee will have received more information about economic developments ahead of its next monetary policy meeting in June, when new forecasts will be presented.”

Markets took that to heart. They are pricing at least one more quarter point cut by year-end. To what extent the central bank may bring forward guidance for future easing toward a more neutral setting will be key compared to prior projections (chart 13). Sticky core inflation at 2.8% could even preserve existing guidance.

SNB—NEGATIVE RATES AGAIN?

Wait a minute, I thought we got rid of negative yielding debt (chart 14)!

The Swiss National Bank could well bring back some of it in Thursday’s decision. Most within consensus expect the central bank to cut its policy rate by 25bps to 0%. A small minority think that it could dip into negative territory by cutting by 50bps. Markets are somewhat on the fence with about 30bps of a cut priced in and so -50bps would be the more significant surprise.

Why ease further? The SNB is fighting the franc. It’s up another almost 9% to the dollar since the last decision on March 20th with most of the move coming around US ‘Liberation Day’ on April 2nd. 150bps of cuts since March 2024 have been unsuccessful at weakening the currency.

Why does it matter? For two reasons. First, franc strength has made it more difficult for the SNB to achieve its stable inflation target of 2% with inflation presently running at -0.1% y/y and core CPI at just 0.5% y/y. Second, it jeopardizes growth in a significantly export-driven economy alongside global trade tensions.

Fresh forecasts are due at this meeting with previous ones available here. In its last projection in March, the SNB expected a protracted period of weak inflation at just 0.4% y/y this year, and 0.8% in each of the next two.

PHILIPPINES CENTRAL BANK—THE BALANCE HAS TILTED

Bangko Sentral ng Pilipinas is expected to cut by another 25bps to an overnight borrowing rate of 5.25% on Thursday. At 1.2% y/y, inflation remains almost non-existent. The policy rate remains in restrictive territory. Since the last cut on April 10th, the peso has continued to appreciate to the dollar. Weak inflation and a reasonably stable currency with a policy rate in restrictive territory tilt the balance toward addressing downside risks to growth.

BANK INDONESIA—A CASE FOR A CUT

Bank Indonesia faces a tough call on Wednesday. Consensus leans toward hold the policy rate at 5.5% with a significant minority calling for a 25bps cut.

The rupiah has been steady since the last decision on May 21st and inflation fell further to 1.6% y/y (1.95% prior, 1.9% consensus) in May with core CPI slipping a tick to 2.4% y/y. That could merit an easing bias given that guidance on May 21st pointed toward “closely monitoring room to support economic growth further in line with global and domestic dynamics.”

CBCT—EXTENDING THE LONG HOLD?

Taiwan’s central bank is expected to hold its benchmark policy rate at 2% on Thursday where it has been since March 2024. Recent inflation offers room to ease with CPI running at 1½% y/y and so does the Taiwan dollar’s gain of over 11% since the last decision in March while outperforming other Asian crosses, but the central bank may wish to further evaluate uncertain effects of global developments on inflation and growth.

TURKEY’S CENTRAL BANK—FOOL ME ONCE…

After surprising markets with a 350bps hike to 46% on the one-week repo rate at the April 17th decision, economists are in widespread agreement that the Central Bank of Turkey will hold on Thursday.

Is there scope for being surprised again? You bet. The lira has continued to depreciate since that large hike and is down by another 3½% to the dollar and more relative to other EM crosses (chart 15). The main reason for the central bank’s concerns over time has been the import price pass through of a weakening currency into inflation that continues to run at 35% y/y on headline and core measures.

GLOBAL MACRO ROUND-UP

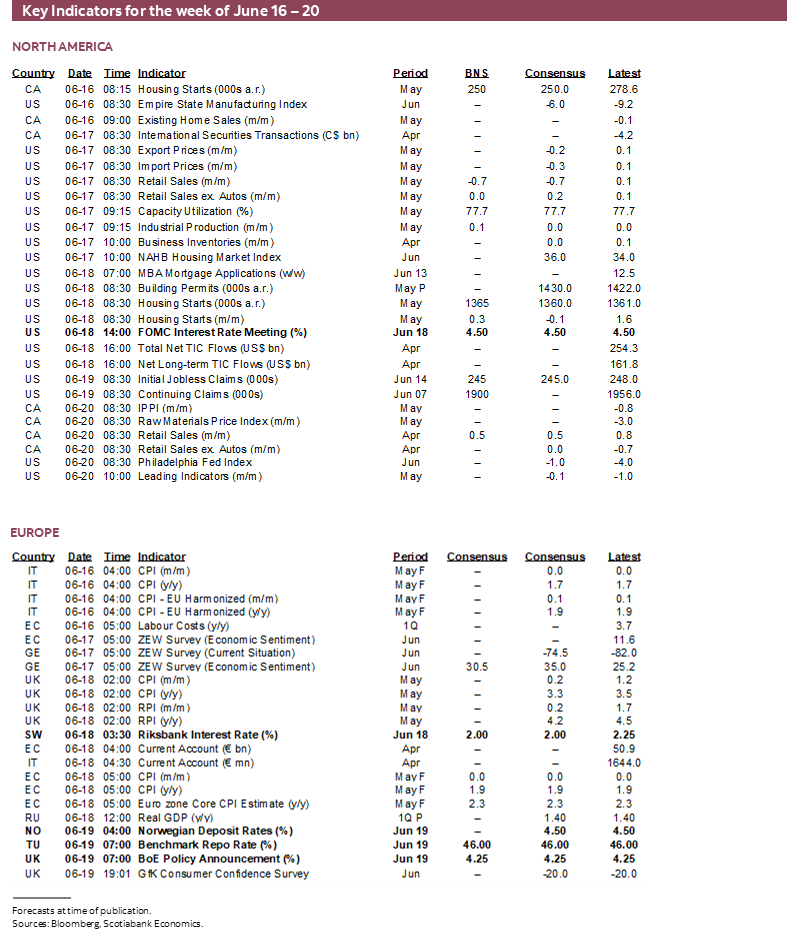

Central banks, the G7+ meeting, and further developments in the Middle East will likely dominate volatility across global markets. The line-up of global indicator releases is comparatively light and summarized in chart 16.

Canada faces a light calendar and will spend most of the week watching developments elsewhere and at the G7+ meetings. Housing starts and existing home sales in May (Monday) and then retail sales in April with May guidance plus producer prices in May (both Friday) will book-end the week’s data risks. Key among them may be the retail figures that were guided to be up by 0.5% m/m SA in April back on May 23rd. Watch for possible revisions, how much of that was due to prices versus volumes, and then guidance for May.

The main US release on the docket will be Tuesday’s retail sales report for May. That could be a soft reading based upon what we know from observables like the drop in auto sales as the tariff front-running subsided, and gasoline prices. Core sales growth may also be on the soft side. The US will also refresh industrial output in May (Tuesday).

Australia’s job market has been defying gravity for a quite a while. Whether that can continue will be revisited when May’s figures land on Wednesday. Employment has increased in three of the four months so far this year and not just by small amounts. On net, jobs are up by 114k year-to-date.

Some moderation is expected when the UK refreshes inflation stats for May on Wednesday before the BoE’s decision the next day. That’s because the prior month’s 1.2% m/m rise in CPI was driven by Ofgem’s hike to energy price caps starting in April through to the end of June. Some forecasters think that the month-over-month rate of increase could flat line. Ofgem has already guided that electricity and gas prices are slated to drop by 7% over Q3 compared to the Q2 gap. Still, watch core CPI that in April was among the hotter readings in m/m NSA terms compared to like months of April in history, and likewise for services CPI (chart 17). The UK also refreshes retail sales for May on Friday after most of the key developments and they are expected to reverse some of the prior month’s surge.

Kiwi GDP for Q1 (Wednesday) is expected to repeat the prior 0.7% q/q SA rate of expansion as the main remaining release with little else on tap globally.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.