Next Week's Risk Dashboard

- Powell won’t buckle under pressure to cut

- Mr. Carney goes to Washington

- Federal Reserve: Patience!

- Canadian jobs to get a lift from the election

- Aussie election: will Albanese retain control?

- BoE: The pattern says ‘cut’ this time

- Norges Bank to stick to its guidance

- Riksbank may repeat that it’s done

- BCB expected to gear down

- BCRP faces a divided consensus

- The Ringgit might give Negara more room

- Global macro—key may be Chinese inflation

Chart of the Week

In the game of chess, checkmate stands for when the King has failed to execute sound moves and has no way to escape. Federal Reserve Chair Powell can declare checkmate on President Trump who will nevertheless be displeased with the FOMC as this week’s main event.

For one thing, there is no reason to be easing to this point, and it’s likely that we’ll hear Powell say as much about the next meeting as well.

For another, Powell’s warnings on the effects of tariffs that drew Trump’s ire are on the cusp of being borne out. Sometime between now and the next FOMC meeting in June we are likely to begin to see shelves becoming bare across key US retailers and many prices soaring. A supply shock through no product availability due to absurdly high tariffs could begin to exceed the likely negative demand shock. As markets apply what I think is selective hearing toward the shoddy state of global trade negotiations allegedly with 200 countries—five more than exist with a liberal definition of country—they’ll come to grips with the damage to growth, inflation and jobs.

Several other central banks will also weigh in within this difficult environment including the Bank of England and five others. Australia’s election results, Canada’s latest job market readings and several other global macro indicators are also on the docket.

A litmus test of the US sincerity to strike trade deals will come on Tuesday. Will Trump take out his volatile frustrations on Canadian PM Carney that day? Or will the air of desperation within the US administration to strike deals offer a more conciliatory tone?

MR. CARNEY GOES TO WASHINGTON—THE BENEFIT OF THE ZELENSKYY MOMENT

Canadian PM Mark Carney and his entourage will trudge down to Washington to meet with US President Trump and his own entourage. The format, length and time are unknown at the time of publishing.

The advantage to the appalling Zelenskyy moment when he was ambushed in the Oval Office is that once revealed, the tactics are more easily averted in subsequent rounds. That general line of reasoning also explains why I’m not a big believer in the ‘art of the deal’ nonsense. It would be irresponsible of the Carney administration to agree to the possible risks of a staged ambush which is probably why Carney emphasizes that he—like the former Canadian administration the last time around—won’t negotiate in public. Maybe have a talk together on Carney’s CFC1 Airbus A-330-200 plane as Trump waits for his.

Still, the risks may be high and mostly in terms of Trump’s penchant for stirring unpredictable chaos. Trump’s election day social media post sound as belligerent as ever toward Canada. To me, it feels premature to be holding this meeting at such a high level unless they have significant confidence that work being done in the background by bureaucrats and technocrats have been making serious, largely undisclosed progress outside of the recent news that Canadian auto parts companies get a two-year pause on tariffs. That step, by the way, should be viewed cautiously; is Trump merely pushing off another fight until after the midterms on November 7th, 2026?

Nevertheless, the Carney administration is quickly lining up its ducks. The plan is to announce a new Cabinet on May 12th, and Carney did not commit to retaining Finance Minister Champagne.

Parliament will be recalled on May 26th with King Charles III and Queen Camilla in attendance amid some domestic questioning over what this says about independence. Ottawa will be taken over by all manner of pomp and pageantry. The King will deliver the Speech from the Throne the next day that will outline general goals of the Carney administration, and the rest of the King’s itinerary for his visit to Canada will be disclosed at a later date. We probably know enough about the goals that will be outlined in the Speech already, given the Liberal platform and Carney’s reinforcement of the main messages this past week.

By Canada Day—July 1st, not the 4th, just to be clear(!)—Carney has pledged a 1% tax cut for the lowest income tax bracket that will heavily favour lower income earners.

A June timeline for a full federal Budget seems to be in the cards. It would have to be passed by Parliament that sits between May 26th and June 20th and doesn’t return until September 15th. That limited window faces high uncertainty around getting key fiscal initiatives and perhaps any possible trade deal passed in time.

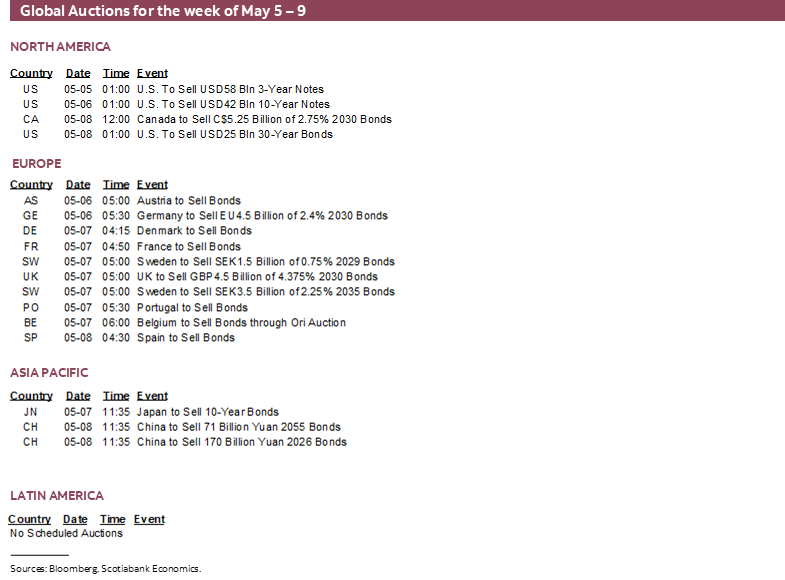

CENTRAL BANKS—POWELL MAY LEAN AGAINST MARKET PRICING FOR CUTS

Seven central banks will weigh in with decisions this week. Key to global markets may be the FOMC, but also on tap are the Bank of England, Norges Bank, the Riksbank, and central banks in Chile, Brazil and Malaysia. The BoC also releases its Financial Stability Report on Thursday. Let’s go.

Federal Reserve—Patience, People, I Said Patience!

The title to this section is what an impatient, frustrated Chair Powell might say to markets that haven’t really gotten the message of late. At the peak in earlier April, markets were pricing about 125bps of cuts by year-end and that has backed off closer to 75bps. That may still be too much for Powell’s liking.

Enter the statement on Wednesday afternoon at 2pmET followed by the usual press conference a half hour later for around 45–60 minutes or so. The next Summary of Economic Projections including a revised dot plot is due at the next decision on June 18th.

I’m expecting Chair Powell to repeat some variant of “we’re not going to be in any hurry to move. We’re well positioned to wait for further clarity.” That’s what he said at the April meeting about this meeting, and he has a case to basically rule out a June cut with similar language. Markets once had about 40bps of a cut priced by June and have backed off to less than 10bps now. That still sounds like too much.

Why? Because of data, and because there is no reason to alter his stance on forward risks to the dual mandate.

On data, he can point to a still-resilient job market as the unemployment rate remains low at 4.2% after 177k nonfarm payroll positions were created in April.

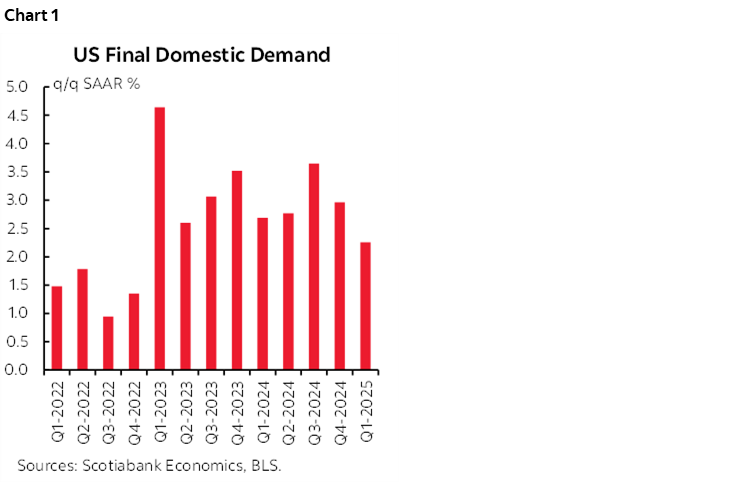

He’s also likely to discount Q1 GDP softness of -0.3% q/q SAAR by correctly noting that it was distorted by tariff front-running with a massive import leakage effect from GDP accounts that knocked about five percentage points off of GDP growth. Instead, he’s likely to point to Final Domestic Demand that remains resilient (chart 1). In essence, final domestic demand continues to grow in excess of potential GDP.

Inflation was soft in March at 0% m/m SA for the preferred core PCE reading, but that’s fresh off readings of 0.5% in February and 0.3% in January and the Committee is likely to smooth through volatile data.

On forward risks to the dual mandate, I still think arguments laid out a few weeks ago remain valid (here). Powell reinforced them at his April 16th appearance in Chicago.

Tariffs will negatively impact employment while raising inflation. Where the balance between the two lies is highly uncertain. As Chair Powell has noted, the FOMC would respond to a shock that poses conflicting influences on its dual mandate of price stability and full employment by being adherent to what it said in its Statement on Longer-Run Goals and Monetary Policy Strategy (here). Paragraph six spells out how they would act in such an instance:

“The Committee’s employment and inflation objectives are generally complementary. However, under circumstances in which the Committee judges that the objectives are not complementary, it takes into account the employment shortfalls and inflation deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.”

As Powell put it, “You think about how far each variable is from its goal and how long it would take to get back. Then ask what do you need to do. If one of them is further away, then you would focus on that one.” In plain English, they would dovishly pivot toward easing if job market conditions deviate from their estimated longer-run 4% neutral unemployment rate and broader assessment of labour market conditions more than inflation deviates from their 2% target. By contrast, they would pivot hawkishly if the opposite were to happen. Should the two be in equal opposition to one another, then the FOMC may be forced into a position that does nothing for some time.

Which narrative comes to dominate is an empirical and data dependent matter with significant uncertainty. That’s why Chair Powell recently stated “It’s just too soon to say what would be the appropriate monetary policy response. We’re waiting for greater clarity before considering further adjustments.”

It’s still too soon. It will remain too soon next month. Expect that message to resonate loud and clear once more. Even the relatively dovish Governor Waller does not have a leg to stand on in terms of his bias toward easing should job markets begin to crater as there is no real evidence that’s happening thus far. Waller dissented at the last meeting because the Committee tapered the pace at which maturing Treasury holdings were allowed to run-off but may be regretting that now. No dissenters are expected this time.

Bank of England—Cut, Hold, Cut, Hold, Cut, Hold… Cut!

The BoE is widely expected to cut Bank Rate by 25bps on Thursday. Markets are fully priced, and consensus is unanimous.

Why? It doesn’t take any great pattern recognition skills to catch on to the alternating patterns of cuts and holds since easing began last August. A 25bps cut is the next move after holding in March.

Data is also on the BoE’s side as core CPI inflation continues to drift lower to 3.4% y/y and with softening service price inflation while job markets weaken (chart 2). Governor Bailey has intensified his tone and is “focused on the growth shock” and it must “take very seriously.”

On that count, key is whether the slow-and-steady alternating pattern continues to be guided, or whether gives a nod to market pricing for most of another cut at the next meeting on June 19th. Refreshed forecasts could do the talking for the BoE.

BCRP—The Fed’s Long Arm

Consensus is divided on the next move by Banco Central de Reserva del Peru on Thursday. Some—including our LatAm economists—expect a hold at a reference rate of 4.75%, while some expect a 25bps cut after three consecutive holds including the last decision on April 10th.

At 1.9% y/y, core inflation in April would support a cut as it has moved below the 2% inflation target.

A concern flagged by our LatAm economists is currency stability and capital flight, should the policy rate differential to the Federal Reserve disappear.

Norges—Because They Said So!

Norges Bank is widely expected to stay on hold at a deposit rate of 4.5% on Thursday—and markets are priced accordingly.

Why? Because they said so. This central bank provides fairly explicit policy rate guidance At its last meeting, it said “The Committee judges that the current stance is warranted for somewhat longer than previously signaled.” Its explicit forward rate guidance has move higher over time (chart 3).

Riksbank—Done!

Sweden’s Riksbank is also expected to leave its policy rate unchanged at 2.25% on Thursday. Consensus is all but unanimous, and markets are priced for a hold.

The last decision on March 20th stated that the Executive Board “Assess that the rate will remain at this level going forward.” Their guidance is shown in chart 4. Markets are not quite in agreement with another 25bps cut priced by the August meeting.

BCB—Gearing Down

After three 100bps hikes in a row following milder increases that began last September, Banco Central do Brasil is expected to downshift back to a 50bps hike on Wednesday. That would take the cumulative increases to 425bps.

Here too, we have a central bank that tees up subsequent decisions rather explicitly. It said at the March meeting that “The Committee anticipates an adjustment of lower magnitude in the next meeting, if the scenario evolves as expected.”

So has it evolved as expected? Yes and no. Inflation in April was stuck at 5½% y/y, but measures of inflation expectations have edged a touch lower (chart 5). Watch the revised inflation forecasts carefully.

Bank Negara—The Ringgit May Provide More Flexibility

Consensus is somewhat divided on Bank Negara Malaysia’s next step on Thursday. Most expect a hold at an overnight rate of 3%, but some expect a 25bps cut. Key is whether Negara pivots more aggressively toward addressing growth downsides as the ringgit has appreciated throughout the past month.

CANADIAN JOBS—THE ELECTION MAY MASK WHAT’S IMPORTANT

Canada updates the state of its job markets with April figures on Friday. This could be a tricky one that requires looking past a possibly rosier headline number and toward the underlying details.

I’ve estimated a gain of 25k jobs and a flat unemployment rate of 6.7%. When adjusted for US measurement concepts it would be like a 6.1% unemployment rate in the US. Canada’s unemployment rate is a half point about the OECD’s estimate of the natural rate of unemployment. By this measure, that makes for a slightly looser job market in Canada than, say, the US where the unemployment rate of 4.2% compares to the natural rate of 4.1%.

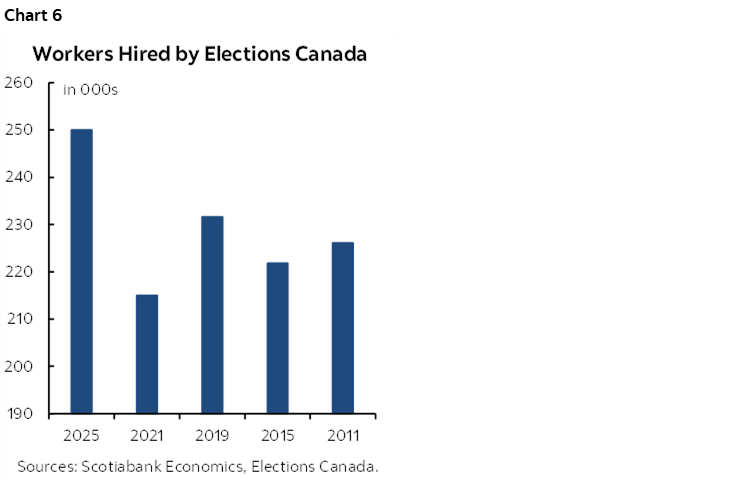

A main driver of the expected gain is likely to be election-related hiring. Elections Canada hired a quarter million workers for this election which was somewhat more than in recent elections perhaps reflecting such factors as the population surge and redrawing of electoral districts (chart 6). Canada emphasizes security over efficiency with manual vote counts and so productivity isn’t any more of a thing during elections as any other time. There won’t be a quarter million jobs created in the report though.

Key is how many of these will show up in the reference week of April 13th – 19th. That week included two of the four days of advance polling that set a new record share of one-in-four eligible voters. Most workers would be hired temporarily much closer to and on the day of the April 28th election and therefore wouldn’t show up in the Labour Force Survey.

Chart 7 provides one way of assessing the impact. It looks at past elections and what happened to public administration jobs—the category in which election hiring directly shows up—during the reference week of the month in which the election was held. It also distinguishes between times when the advance polling overlapped with the reference week. In recent elections, tens of thousands of jobs have been temporarily created to run the election when the reference week included at least two of the advance polling days as it did this year.

The rub lies in the fact that most other indicators suggest that job growth momentum has probably cooled. One is volatility in the retail sector that has faced a hot mess of GST/HST distortions, post-holiday hangovers, weather effects, sagging confidence, and store closures. The retail sector lost about 8k jobs in March after gaining 27k in February and before that another 26k in January after losing 30k in December before the bulk of the effects of the mid-December GST/HST cut arrived. There may be further downside here including uncertainty toward timing cuts at a large department store chain that will probably be more fully captured in the May jobs report.

Further, CFIB small business hiring attitudes have soured and job postings have been softening a bit.

As for tariffs and trade tensions, chart 8 shows that trend job growth in manufacturing slowed the last time Canada and the US went head-to-head on trade tensions in 2018–19 and there was significant volatility with some declines mixed in, but on balance, employment grew through that period. In fact, employment was up by almost 570k jobs by the end of 2019 compared to the end of 2017. This time is a bigger deal, but there is still a case for meeting demand with more labour that is easier to adjust than more capital.

A relatively soft seasonal adjustment factor for months of April in recent years may nevertheless restrain net upside to jobs (chart 9).

AUSTRALIAN ELECTION—THE STATUS QUO?

Australian’s will choose their next PM and a different composition of the House of Representatives and Senate this weekend. All polls will have shut by 8pmET (6amET). Media may call the election as soon as Saturday night local time, unless the vote is very close in which case it could take throughout the week and possibly longer to call the outcome.

Australia has a preferential voting system which means that if the candidate one voted for doesn’t win, then their vote will be passed to their second choice, and then the third, and so on, until a single candidate in the seat secures more than half of the votes. Chart 10 shows what the polls expect for both the primary and ultimate outcomes. The primary vote doesn’t reveal a clear winner in terms of voters’ first choices. The current PM—Anthony Albanese—and his Australian Labour Party is tied on the first pass with his opponent—Peter Dutton—and his Liberal-National Coalition.

If the polls are correct not only on the first but also subsequent choices, then the incumbent ALP administration is likely to win as shown in the two bars on the far right hand side of the same chart 10. Polling momentum has swung in their favour. It seems to me that potential polling error is more likely to be compounded in Australia than simpler systems like Canada’s.

The ALP has a slim majority in the current composition of the House of Representatives but the L-NP opposition has a slim majority in the Senate for divided chambers (chart 11). All of the House seats are up for grabs and just over half of the Senate seats.

Like Canada, a record share of voters has already made their choices in advance polls with 22% of eligible voters having weighed in already.

Markets may be more vulnerable to a surprise ALP loss. ALP seeks to cut the tax rate by two points to 14% over two years, offer an additional tax deduction for some, boost mining and processing of critical minerals and renewable energy, while probably continuing to improve ties with China. Dutton is a China hawk, pledges to reduce immigration and public sector spending. Both parties have similar stances on improving the cost of living and both are likely to pursue expansionary fiscal policies.

GLOBAL MACRO—CHINA’S MOUNTING DEFLATION RISK

Chart 12 shows the rest of the global line-up of indicators not discussed so far. It’s a relatively light week for what’s left.

The main focal point will be a batch of CPI inflation numbers out of countries including China that may start to reflect massive bilateral tariffs with the US, Philippines, Taiwan, Thailand, Chile, Colombia, Mexico, Sweden, Norway and Switzerland. Unfortunately, China’s figures arrive on Friday night when the world’s markets are shut.

The main releases out of the US will be ISM-services for April (Monday) that will likely soften, and Q1 productivity and unit labour costs (Thursday) that will probably show weak productivity and probably the biggest surge in productivity-adjusted employment costs since 2022.

The next RBNZ decision isn’t until the end of the month, but this week’s Q1 job growth and wage figures (Tuesday evening, ET as always) will be the last batch of major labour market readings before then. Job growth is expected to remain stalled after contracting in third of the prior four quarters while wage growth has been somewhat off the peak rates during 2022–23.

Canada updates trade figures (Monday) that will further inform Q1 GDP expectations and influences to start Q2 by way of tariff front-running activity. The Ivey (Tuesday) and S&P composite (Monday) PMIs will be updated for April.

Q1 GDP figures from Indonesia (Monday) and Philippines (Wednesday), Q1 wage growth in France (Wednesday), German factory orders, industrial output and trade (Wednesday to Thursday) and several industrial output readings across Europe round out the line-up.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.